Advanced Scenario Analysis

How we helped a leading UK insurer transform their ORSA and ICARA processes

Client Overview

Our client, a mid-sized UK insurer with operations across personal and commercial lines, faced challenges in developing robust, defensible scenario analyses for their regulatory Own Risk and Solvency Assessment (ORSA) and Internal Capital Adequacy Assessment Process (ICARA) submissions. Their existing approach relied heavily on subjective expert judgment with limited quantitative rigour, creating concerns about defensibility and strategic value.

Key Challenges

- Insufficient quantitative basis for scenario selections and parameters

- Limited ability to integrate emerging risks into the assessment process

- Difficulty defending scenario severities to regulators and board members

- Scenarios weren't effectively linked to business decisions and strategy

- Process was time-consuming but delivered limited business value

Our Approach

We implemented a Bayesian network model to capture interrelationships between risk factors, allowing for more realistic scenario generation that accounted for correlation and cascading effects.

We designed the framework to explicitly address PRA and FCA requirements for ORSA and ICARA, ensuring compliance while delivering strategic insights for business planning.

We integrated historical data, market indicators, and expert judgement into a unified framework, creating a more objective basis for scenario development and stress testing.

We facilitated cross-functional workshops that brought together risk, finance, underwriting, and business teams to develop scenarios that were both technically sound and business-relevant.

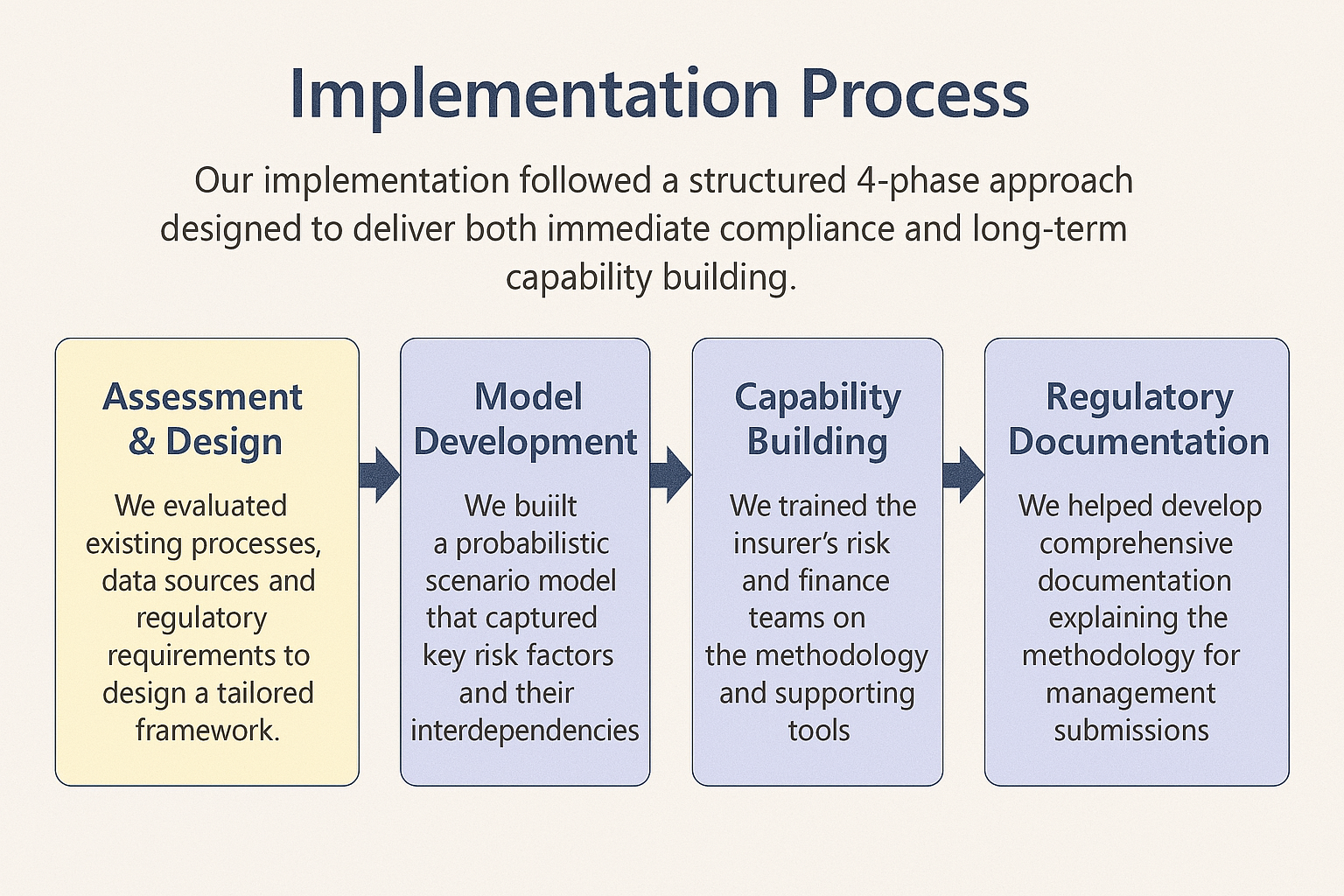

Implementation Process

Our implementation followed a structured 4-phase approach designed to deliver both immediate compliance and long-term capability building.

- Assessment & Design: We evaluated existing processes, data sources, and management requirements to design a tailored framework.

- Model Development: We built a probabilistic scenario model that captured key risk factors and their interdependencies.

- Capability Building: We trained the insurer's risk and finance teams on the methodology and supporting tools.

- Documentation: We helped develop comprehensive documentation explaining the methodology for reporting submissions.

Results & Benefits

The insurer received positive feedback from the PRA on their ORSA submission, with regulators specifically noting the improved rigour in scenario selection and analysis.

More precise risk quantification enabled the insurer to optimise their capital allocation, resulting in an estimated 8% improvement in capital efficiency.

The framework provided insights that directly informed the insurer's three-year strategic plan, including decisions on product mix, reinsurance strategy, and growth initiatives.

Despite the increased analytical depth, the streamlined process reduced the time required for scenario development by approximately 30%, allowing more time for analysis and business application.

"Risk Portal's approach to scenario analysis has transformed what was previously a compliance exercise into a valuable strategic tool. Their methodology combines technical rigour with practical business application, giving us both regulatory confidence and actionable insights for our business planning."

— Chief Risk Officer, UK Insurer

Looking for Similar Results?

Whether you're looking to enhance your ORSA/ICARA processes, implement advanced scenario analysis, or improve your overall risk management framework, our team can help you develop approaches that satisfy regulators while delivering real business value.